We all know that in this world, there are a set of people you can’t trust more than your friends, colleagues, mentors and in some cases even yourself. You know who they are, your parents.

We should seek their advice as they have a lot of experience and their intentions are always good when it comes to their children. However, there are some areas where you are better off not taking their advice.

For example, if you had to undergo an open-heart surgery, would you rely on your father or mother to diagnose the problem, recommend a solution and finally, perform the surgery? Of course not, the only exception would be if they are the leading cardiac surgeons themselves. They may be well intentioned no doubt, but the issue is that they may not have the expertise.

There is another, equally important area where the same logic applies – the area is of Personal finance or Money management. Unfortunately, parents believe that they are qualified enough to give money advice as it is in their child’s best interest and the children take it, because they do not understand any better. Again, intentions maybe good but the results may prove otherwise.

There will be exceptions as with everything, if either of your parents is good with managing money themselves, meaning they have a track record of generating higher returns than the financial products in the market on a sustainable basis. But let’s get real here this only applies to a small fraction of the population.

At this stage, I hear you say or your parents rattle out stories of how they have lost money in the markets because of trying to invest themselves or relying on commissioned agents from banks and Insurance companies. I agree there is a lot of mis-selling out there and it will continue but, if you just focus on the trust component and do not do your due diligence on expertise, it may result in an opportunity loss in lakhs if not crores depending on your earning and investing pattern.

The problem is that if you do not have expertise, you tend to go with the default options which in case of investments is bank deposits or expensive insurance products, both of which will give you negative or near zero real returns over the long term. Real returns mean returns after inflation and tax, the only returns that should ultimately matter- not my verdict but given by one of greatest investors of all time, Sir John Templeton.

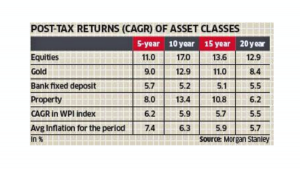

Lets compare the real returns of products typically popular with parents such as property, fixed deposits and gold with one that they are very wary of i.e. equities. Refer to the research by Morgan Stanley in the table below:

One striking observation from the table above, is that for every period from 5 to 20 years the bank fixed deposits have given negative real returns e.g. over 5 years the post- tax returns is 5.7% and average inflation is 7.4% so the real return is -1.7% (5.7%-7.4%), which means that your money can purchase less amount of goods and services as the value of your deposits has fallen by 1.7%.

Let’s compare how property fared against equities over a 20 year period. From the table, real returns for equities works out to 7.2% and the same for property comes to 0.5%. i.e. if you had invested Rs 1 lakhs in equities that would have grown to approx. Rs 4 lakhs in real terms after 20 years and the same amount in property would have grown to Rs 1.1 Lakhs i.e. almost 4X returns.

So, what do you do?

At the end of the day, you have an objective to attain, it could be as basic as a return percentage or an important goal such as buying a house, saving up for your child’s education or building a nest egg for retirement. Your job is to make sure that the goal is met and for that, you should have the ultimate say in where to invest.

Managing money through the various cycles of markets is complex, you may have a trusted advisor in parents who will try and keep your money safe but the lack of expertise will hinder your chances of achieving any meaningful financial goal as the real returns would be close to nothing for the traditional investment products. Time to take responsibility and take control of your finances, start investing in mutual funds which are managed by experts and regulated by SEBI.

Happy Investing!

By Arjun Sarkar, Chief Evangelist of SIPtm